Asset Classes

Multi Currency Cash Accounts

Fixed Income

Equity / Funds

Private Equity

Listed & OTC Futures

European Options

Platform Features

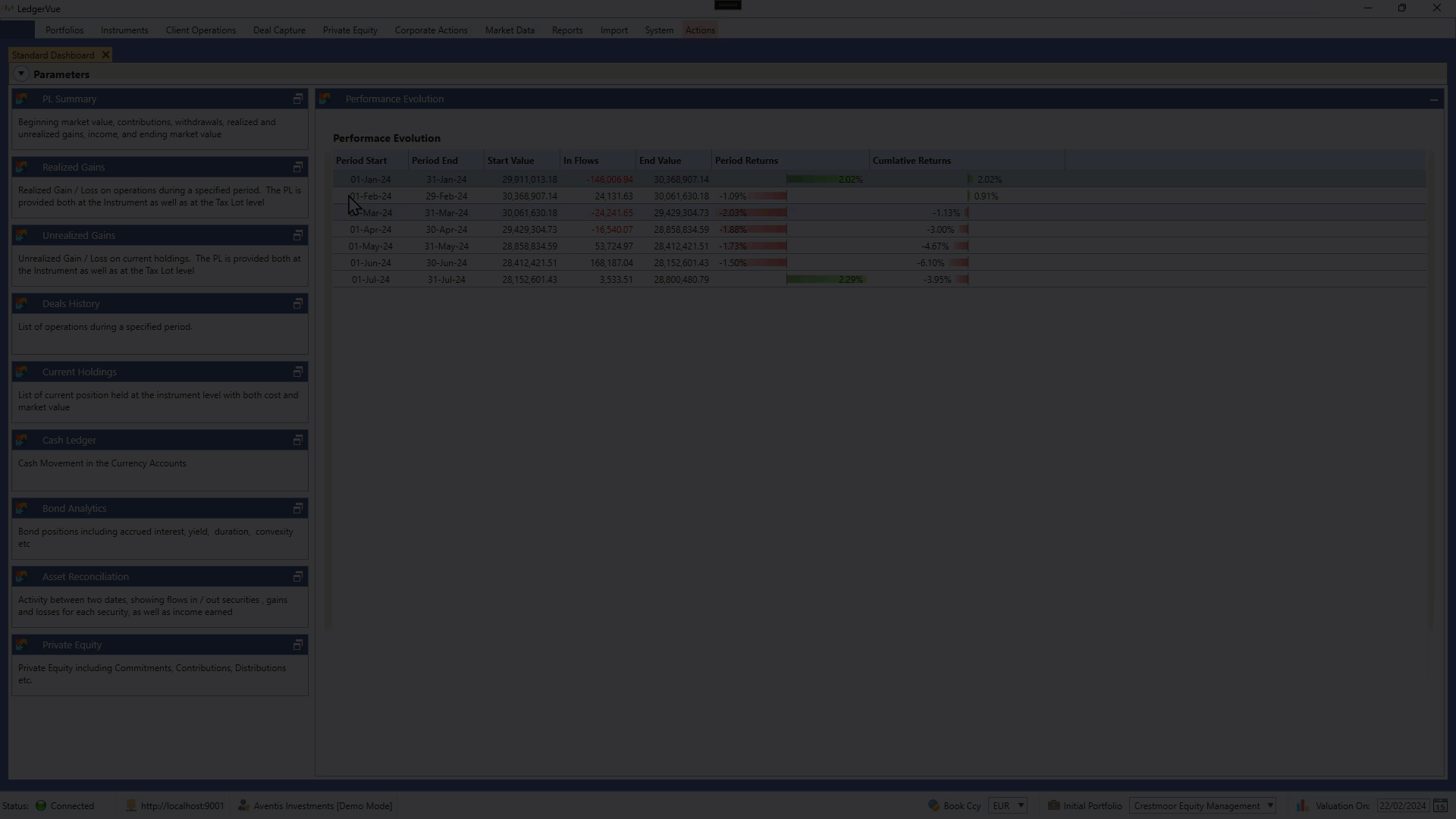

MWR / TWR Return Calculation

Money weighted return calculation for a client perspective as well as Time weighted return for portfolio manager performance

Support for Tax Lot Costing

Track cost at tax-lot level using multiple costing strategies for accurate realized vs. unrealized gain/loss reporting

Mark to Market Listed Futures

Automatic generation of your Mark-To-Market events and creation of cash flows for exchange-traded futures.

Options Exercise / Expiry

Automatically handle Expiry Events of European option contracts for both physical delivery or cash settlement

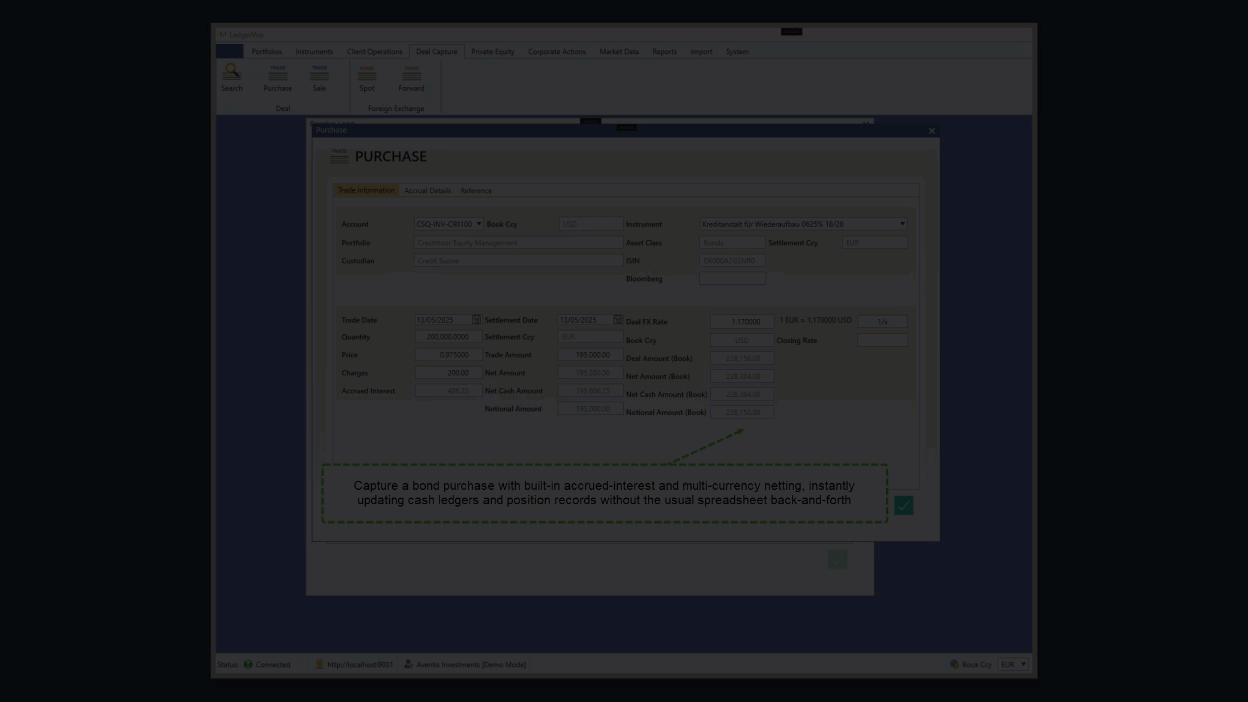

Bond Interest Accruals

Handles interest accruals for accurate valuation accounting.

Cash Flow Projections

Project your expected cash flows, automatic coupon payments and principal redemption events.

Modern Technology Stack

Real-Time Push Notifications

Server-push (WebSocket-based) for live updates on trades, price changes, and custodian imports. Enables auto-refreshing dashboards and alerts

Market Data Connectivity

Supports multiple market data providers for end of day instrument pricing & Fx rates for accurate valuations across public and OTC assets.

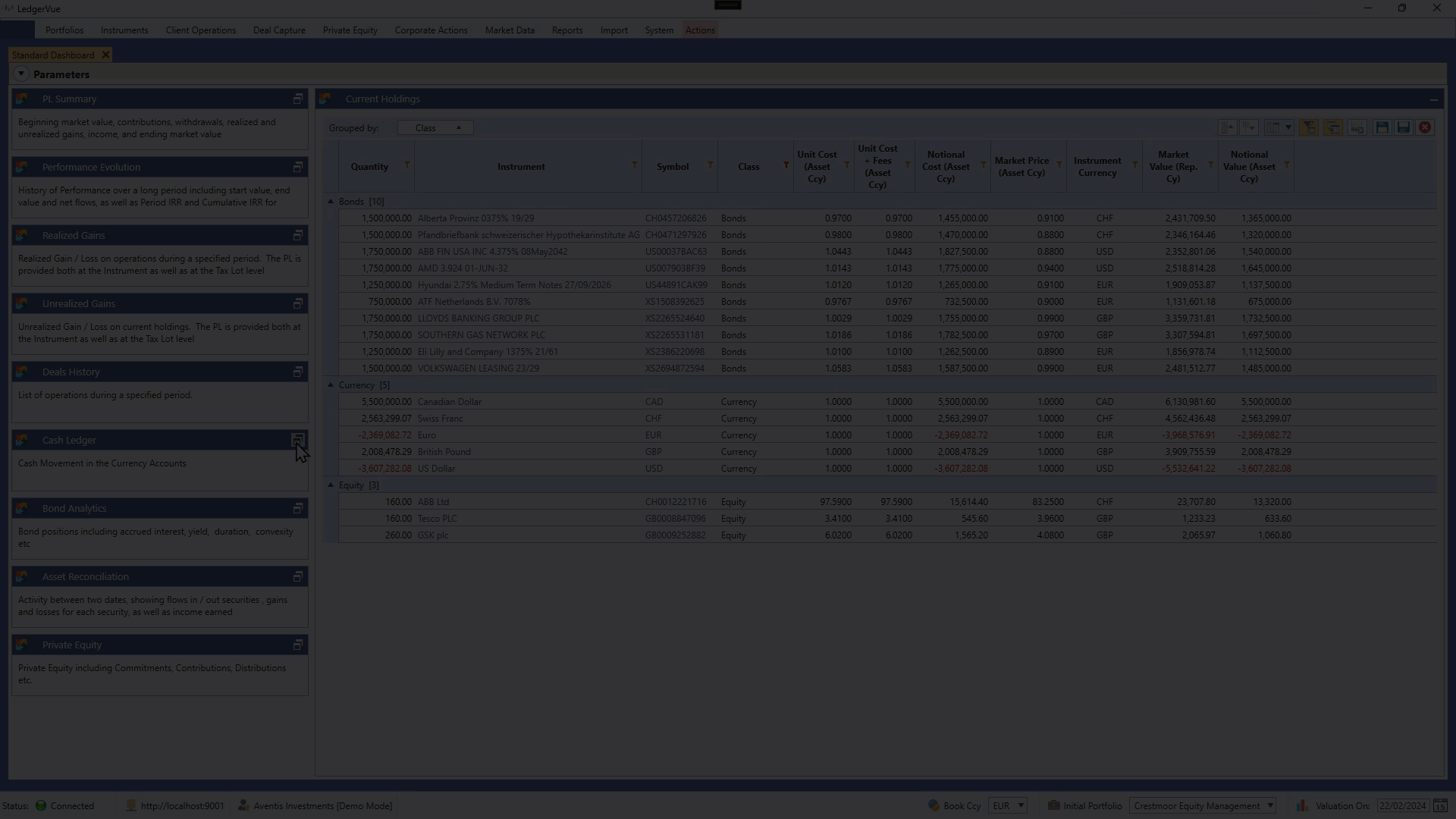

Personalized User Dashboards

Drag-and-drop panels, personalized layouts, flexible grouping, filtering and column choice in data grids, and multi-monitor workspace support.

Instrument Model Language

Domain Specific Language allows us to precisely model financial contracts with complex cashflow / lifecycle events

Event Sourcing Architecture

Every transaction/change is stored as an immutable event. Provides full audit trails, data reconstruction, compliance support, and system resilience

Engineered to Evolve

Powered by the .NET stack, our platform follows Clean Architecture and domain-driven design, keeping business logic separated from infrastructure for effortless evolution. The codebase has a comprehensive suite of Tests

Portfolio Consolidation Tool for Modern Wealth Management

Automated Investment Reporting

Our wealth management software automates custodian transaction imports and consolidates your multi-asset portfolio tracking into a unified investment performance reporting dashboard.

Numbers You Can Trust

Integrated market data and automatic instrument lifecycle tracking reduce risk of errors in your valuation reports.

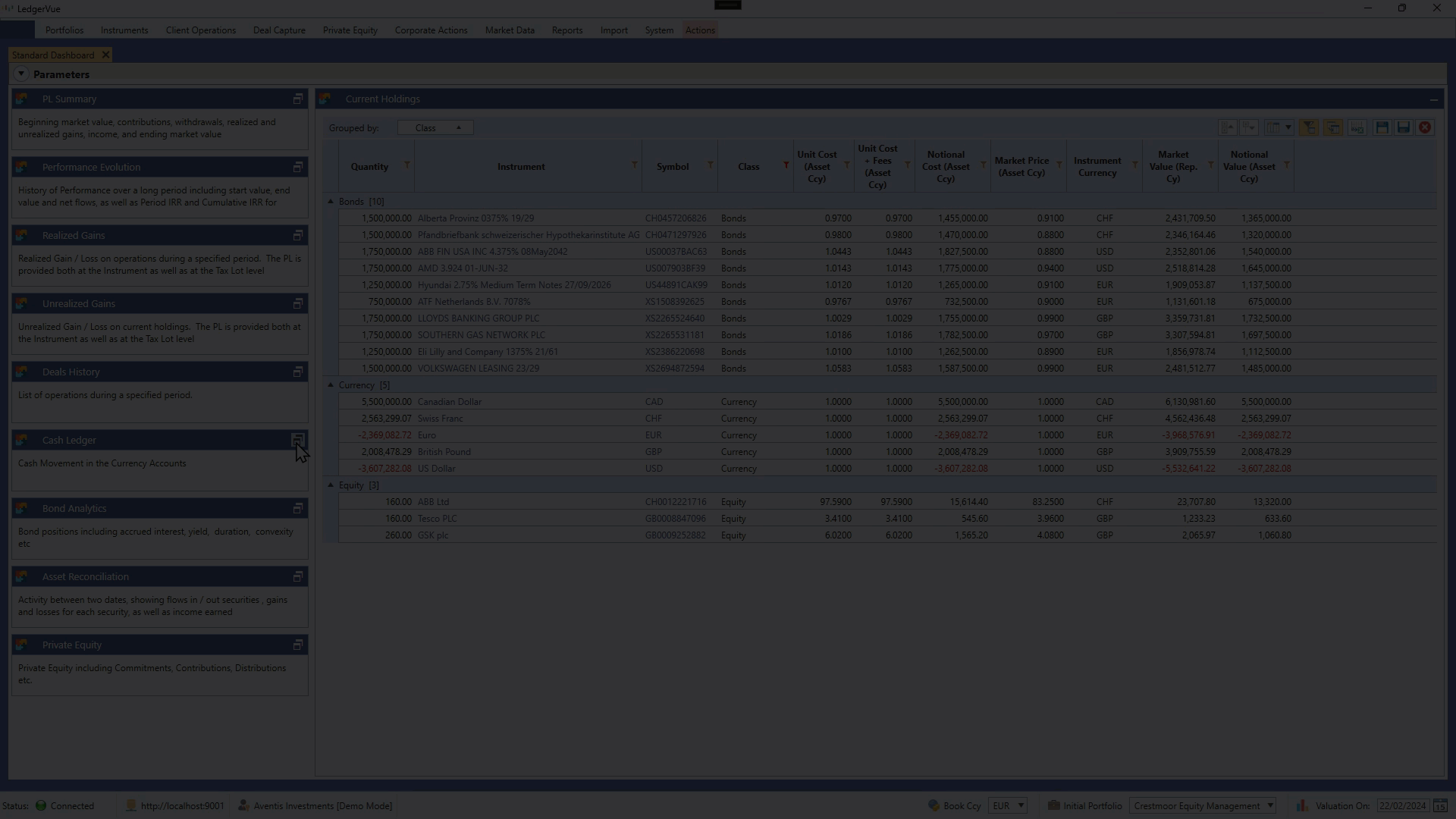

Real-Time Portfolio Consolidation

Navigate through customizable family office software dashboards and analyze client performance with our comprehensive asset management platform in minutes, not days.

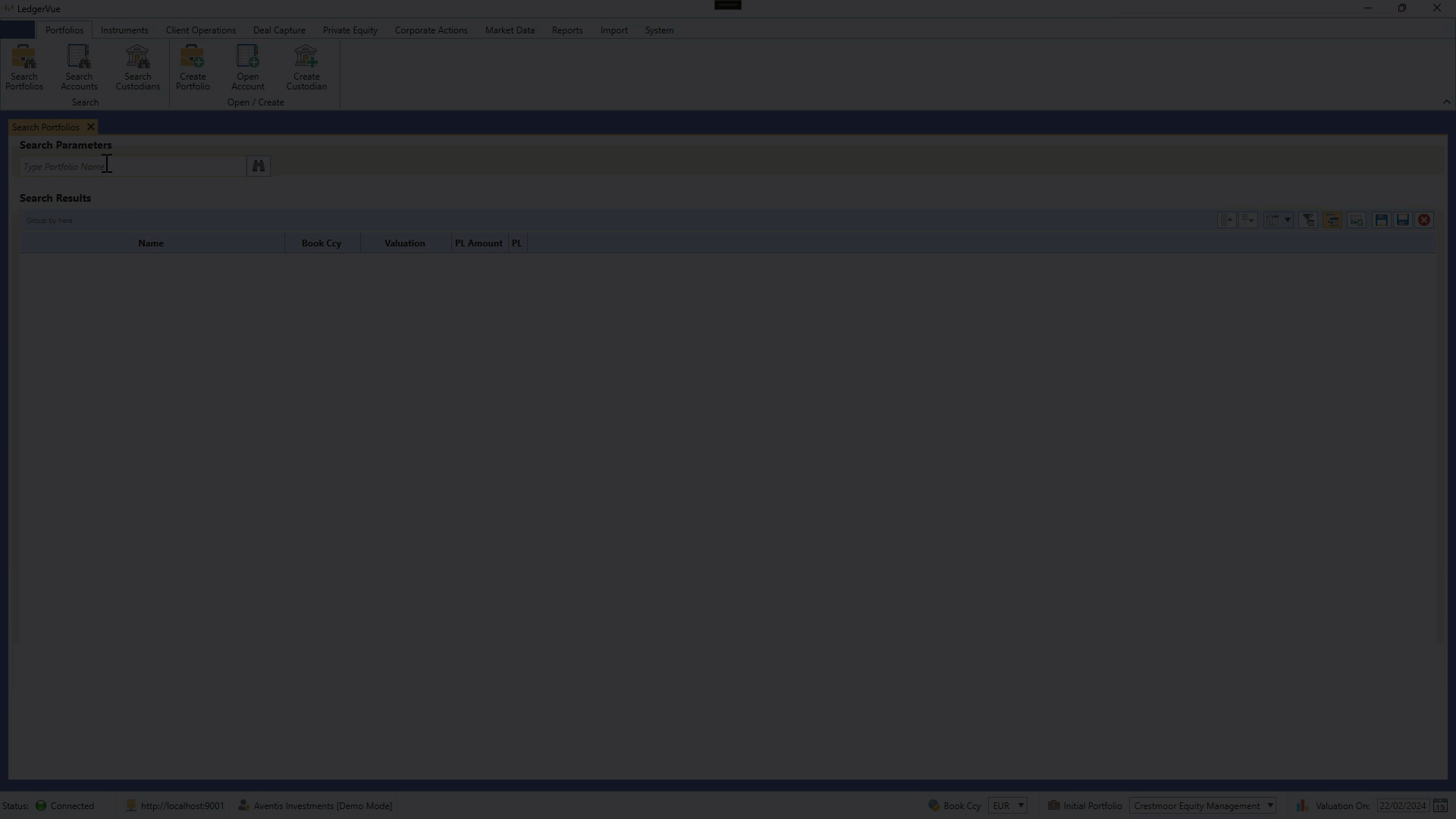

A Glance Inside the Interface

Take a quick glance through screen snapshots that walk you through the interface, from summary dashboards to drill-down detail views. Each image highlights how effortlessly you can pivot between views.

Team

Who We Are

Fares EIDI

Co-Founder & CEOFares brings over 20 years of building software systems for various industries. As a certified Business Analyst (CCBA) and Professional Scrum Master, Fares bridges the gap between business requirements and technical implementation. His domain expertise spans asset management systems, trade lifecycle processing, and performance measurement tools.

Marc LEROY

Co-Founder & CTOMarc brings over 20 years of .NET full-stack development expertise, mastering the complete software development cycle. As a certified .NET Enterprise Developer, he specializes in cloud-native architectures, distributed systems, and microservices design. His expertise spans containerization technologies, API-first development, and domain-driven design principles, enabling him to architect scalable cloud solutions that deliver clean, maintainable code for complex projects.

Stephen Allen

Strategic AdvisorStephen brings 20 years of experience in the Family Office ecosystem, having built and led both Single and Multi-Family Offices as well as global Family Office services for a large financial group. Aside from his experience in investment analysis he brings all-round capabilities across finance, governance, operations, and succession planning—ensuring our product is fully aligned with the needs of our clients.

David Laou

Strategic AdvisorDavid brings over 20 years of securities and investment industry experience as a CBAP-certified business analyst and change manager at major financial institutions. He is also a certified Architect, Scrum Master, Product Owner, and impact analyst, with CFA Level II passed, specializing in portfolio management systems. David provides broad industry insights, operational solutions, and understands stakeholder needs.

Strategic Partners

FINETICA

Private Banking Systems ExpertDeep expertise in private banking systems optimization and intelligent configuration. FINETICA specializes in diagnosing operational inefficiencies, standardizing reporting landscapes, and maximizing platform ROI through smart configuration strategies that boost efficiency and reduce operational risk without custom development.

Learn MoreF.A.Q

Frequently Asked Questions

Can we try LedgerVue before committing?

Yes—independent asset managers can run a fully featured, no-cost, three-month pilot on either cloud or on-prem infrastructure, using live market data.

Can I report performance in my client’s home currency while managing in another?

Yes. Positions re-value in any currency you pick; gains are split into price, FX, and cross components so the client sees the exact source of returns

Do you handle private-equity investments?

The system is specifically designed for Limited Partners (LPs) who invest in private equity vehicles, providing essential portfolio management tools to track their investments focusing on monitoring capital calls, distributions and valuations, calculating key performance metrics like IRR, MOIC, DPI, and RVPI as well as liquidity planning through cash flow projections.

What position costing methods are available for tax reporting?

Set the cost-basis method—FIFO, LIFO, or weighted-average—at the portfolio level, and the platform automatically carries that lot selection into all realised-gain reports.

Can I import trades from my custodian or broker?

Yes. Upload transaction files or contract notes, via our open import interface. Either way, data lands in the event store fully validated and ready for reconciliation.

How does your architecture help with compliance?

Every change is stored as an immutable event which allow you to recreate any portfolio exactly as it was “as-known-at” a past date, providing a full audit trail .

Pricing

Check Our Affordable Pricing

Starter Plan

Most affordable way to work with our platform with limited access to its feature set.

- Currency Cash Accounts

- Equities / Funds

- Fixed Rate Bonds

- End of Day Pricing

Business Plan

Access all Platform features, with both rich desktop client as well as authorization for API access.

- Listed and OTC Futures

- European Call - Put Options Contracts

- Floating Rate and Zero Coupon Bonds

- Import Custodial Data Adaptors

- Migration of Legacy Data

- Technical Support (48 hours)

Developer Plan

Full API Access to Platform (RPC JSON)

- Define Instruments, Custodians, Accounts etc.

- Capture Portfolio Deals (Buy / Sell) Securities

- Capture Client Operations (Security Transfer, Deposits / Withdrawals, etc)

- Query Report Library (PL, Performance, Transactions, Reconciliation etc)

- Manage Market Data API (run jobs, etc.)

Contact Us

If you have any questions or inquiries, please feel free to reach out to us.